MARKET UPDATE

The S&P 500 bounced after April’s pullback, gaining 4.96% in the month, with a substantial portion of those gains happening in the first half of the month. Small caps slightly outperformed while mid-caps underperformed with the Russell 2000 gaining 5.01% and the Russell Midcap gaining 2.85%. Globally, developed markets largely kept pace with US markets with the MSCI EAFE up 3.87% while emerging markets lagged, gaining 0.56%. In May new record highs were set in both the S&P 500 and the Dow Jones Industrial Average. The first quarter earnings season along with the latest inflation report helped boost investors’ mood and, at least in part, fuel part of the gains across the month.

Yields on 10-year US government bonds consistently fell through the first half of the month, though partially rebounded across the back half. Overall, bond prices benefited from the decline in rates with the Bloomberg US Aggregate gaining 1.7% with most major fixed income asset classes positive for the month as well. The exception was municipal bonds, which were negative for the month with the Bloomberg Municipal index losing 0.29% in May.

Across May, Federal Reserve officials have messaged that they remain prepared to keep interest rates higher for as long as it takes to tackle inflation. Later in the month, inflation began to improve again after months of seeming stalling improvement in the overall inflationary environment. The stubbornness around inflation helped push consumer sentiment to a five-month low. However, with a positive inflation report market expectations around what the Fed may do continued to bounce around, with the latest probabilities – to be taken with a grain of salt – pointing to a possible September rate cut.

ADVISORS’ PERSPECTIVE

Market sentiment returned to a more positive tone in May after a dismal April, largely because of soft jobs-related data. That data has given the equity market hopes that the Fed will turn more dovish to reduce the strain of higher interest rates on the economy. In addition, a positive first quarter earnings season helped feed positive investor sentiment. The overall economic story continues to be a mixed bag, with the bright spots coupled with areas of concern and the remaining categories being characterized as not great, but not terrible either.

The Job Openings and Labor Turnover Survey (JOLTS) numbers peaked in March of 2022 at 12M job openings. Since then, job numbers have been steadily declining, but are still above pre-covid levels. The decline in job openings has helped show that the Federal Reserve’s rate hikes have been establishing themselves and gaining (some) traction in the economy. Also, the rate that people are quitting their job has also been declining. The two in conjunction could indicate that workers are increasingly skeptical about finding new work at higher wages, potentially helping limit wage pressures in the months ahead.

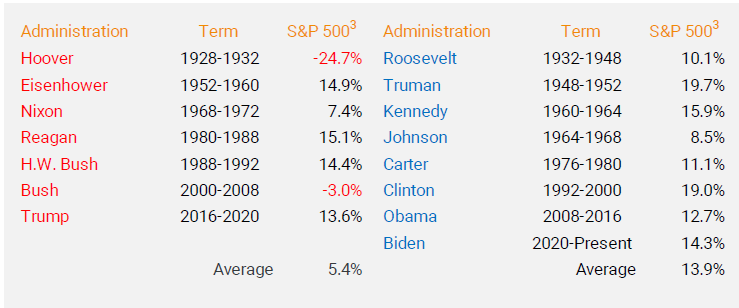

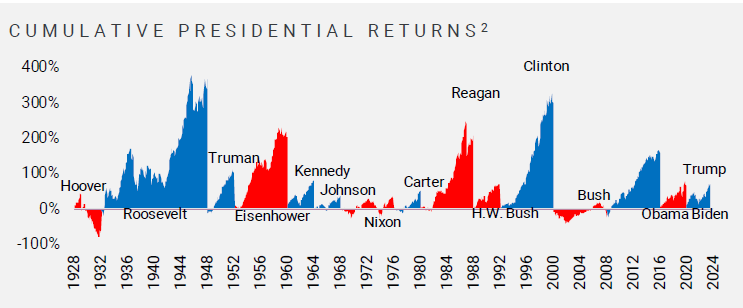

Historically, markets and election years have had no significant correlation. Unfortunately, election years tend to bring out behavioral biases that can bring about investing mistakes. The data below demonstrates the correlation of politics and markets.

The bottom line is elections should never be viewed as investable events, small sample sizes and correlation vs. causation run rampant in the articles and pundits that like to claim otherwise, who usually do it for clicks and viewers, not to help actual investors.

On the other hand, the escalating tension in the Middle East has the potential to cause disruptions in the energy industry if the conflict escalates and the Strait of Hormuz becomes a choke point for oil supplies. Iran has previously threatened to block the strait but has never followed through. An average of 20.5M barrels per day passed through the Strait of Hormuz in

2023, nearly a fifth of the world's total crude oil consumption. Recent events caused S&P Global Ratings to downgrade Israel’s credit rating for the first time, from AA- to A+.

Typically, yields on 2-year government bonds indicate the future direction of Federal Reserve policy. In part, the Fed is comfortable with this and tends to use careful language that subtlety changes over time. In the current environment, however, the market’s expectations have been driven by more than just Fed policy, quickly responding to Fed official comments, inflation reports, jobs reports, etc. The recent environment is likely an exception to the rule. The market is still expecting a Fed pivot to happen, but the timing and speed of the pivot is still a guessing game. Compared to the normally stable bond environment, volatility may last at least a little while longer.

We remain cautiously optimistic and continue to use a quantitative investing approach. In times of uncertainty, it is more important than ever to follow the data and not make decisions based on emotions. Hilltops partnership with Helios relies on facts and data, which we use during our recalculations on a bi-weekly basis. Our models adjust appropriately to market conditions.

DISCLOSURE

This update is not intended to be relied upon as forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Hilltop Wealth Solutions to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecast made will materialize. Additional information about Hilltop Wealth Solutions is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary Report which are accessible online via the SEC’s Investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC # 801-115255. Hilltop Wealth Solutions is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting, or tax advice.