MARKET UPDATE

Equity markets have rallied since November, with Large, Mid, and Small cap all returning over 20% during the last 5 months. However, April saw a broad pullback across most equity asset classes, ending the month with noticeable losses just before the Fed meeting on the first of May. The latest inflation report showed CPI came in just over economists’ expectations, pushing markets lower until they troughed at the end of the third week of the month. International markets also ended in the red, but not to the same extent, ending the month at -2.56%. On the other hand, Emerging Markets were able to avoid a loss, but just barely, gaining only 0.45%.

Fixed income markets also fell during April with a substantial pullback for bonds, but relatively outperformed the S&P 500. US government yields climbed throughout the month on the concern that the recent stubborn inflation numbers will cause the Federal Reserve to hold interest rates higher for longer. As the market has been shifting expectations on the latest data releases, recent expectations have moved to the December meeting for the first rate cut to occur, where several months ago, March was expected to see the first cut.

While the most recent GDP report showed a substantial cooling, the latest economic data may support the higher-for-longer narrative. Real gross domestic product (GDP) increased at an annual rate of 1.6% in the first quarter, falling short of economists’ expectations for a 2.5% increase. This is a notable decline from the 3.4% growth rate in the fourth quarter of 2023 and the troubling mix with inflation introduces uncertainty for policymakers and financial markets, casting a shadow over consumer confidence and the broader economic outlook.

ADVISORS’ PERSPECTIVE

April ended the S&P 500’s five-month positive streak of gains, ending the month down 4.08%. The Russell Midcap and Russell 2000 indices also felt the pressure, where this is their second and largest negative month in the same five-month span, falling 5.40% and 7.04%, respectively. Fixed income markets were also negative for the month, but not to the same extent as equities, with the aggregate bond index down 2.53%. Except for municipals and high yield, other fixed income asset styles were down by at least 2%.

As expectations of near-term rate cuts continue to dwindle, volatility has crept back into equity markets. However, given the strength of equity market trends over the last year, it would require a more substantial pullback than what has occurred through the end of April for trends to turn negative. First quarter earnings results, the latest inflation data, and upcoming Fed commentary will shape the direction of both investor sentiment and equity markets for the month to come.

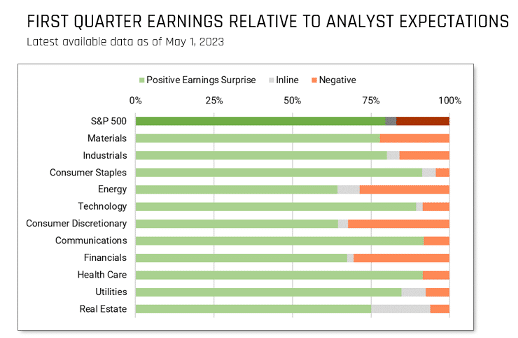

First quarter earnings season is about 60% over, with 309 of the S&P 500 having reported results. Thus far, nearly 80% of reporting companies have beat analyst expectations according to Bloomberg, and across the S&P 500 earnings have exceeded estimates by nearly 9.5%. Quarterly earnings growth has also continued from last month, with a 5.23% gain in aggregate earnings thus far and a slightly slower 4.29% gain in top-line revenue. Longer-term averages show that in a typical quarter 74% of the S&P 500 beat analysts’ earnings estimates, putting first quarter results, so far at least, better than average, despite a few high-profile earnings misses.

Many investors believe the Fed is reaching a critical point in its battle against inflation. And the next couple of months are widely expected to determine whether the Fed can navigate a so-called soft landing for the U.S. economy without tipping it into a recession.In addition to slowing GDP growth, the U.S. Treasury yield curve has been inverted since mid-2022, a historically strong recession indicator. So far, the most convincing argument that a soft landing is still possible has been the strong U.S. labor market.

Leading economic indicators across the globe versus those in the US have been frequently flipping in leadership lately as economies and central banks attempt to get to a more normal environment. However, the deviations have been relatively minor. Evaluating the pace of change in the respective indices can help color which economic environment may be more favorable for companies operating there. The latest data shows that the pace of change in the United States is improving more quickly than those across the globe.

We remain cautiously optimistic and continue to use a quantitative investing approach. In times of uncertainty, it is more important than ever to follow the data and not make decisions based on emotions. Hilltops partnership with Helios relies on facts and data, which we use during our recalculations on a bi-weekly basis. Our models adjust appropriately to market conditions.

DISCLOSURE

This update is not intended to be relied upon as forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Hilltop Wealth Solutions to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecast made will materialize. Additional information about Hilltop Wealth Solutions is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary Report which are accessible online via the SEC’s Investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC # 801-115255. Hilltop Wealth Solutions is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting, or tax advice.