MARKET COMMENTARY

Investment Committee Meeting Highlights

February, 2024

MARKET UPDATE

MARKET UPDATE

The first few weeks of January may have caused some heartburn for investors with the S&P 500 quickly shedding 1.7% in the first few trading days of the year. However, the market rally, at least for US large cap stocks, continued as the S&P 500 went on to gain 1.68% in January. The story was a bit different in other areas of the equity market where the early January selloff was both deeper and longer, leaving other areas of the stock market in the red for January.

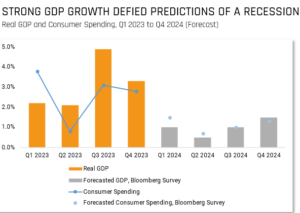

As expected, the Fed held rates steady following their January meeting. The Fed’s statement gave both bears and bulls something to hang their hats on. On one hand, the Fed removed prior language on the possibility of future hikes, while also seemingly tempering the timing of rate cuts by saying it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainability toward 2%.” Only the Fed knows what will dictate “greater confidence,” but the market has begun reducing odds of rate cuts in March, down from 75% before Christmas, to slightly worse than a coin toss. The US economy surpassed expectations for the fourth quarter, raising optimism about the idea of the Federal Reserve achieving a soft landing. Real GDP growth was particularly strong, at a 3.3% annualized rate, but lower than the third quarter’s blowout 4.9% growth rate. Consumer spending and the resilience of the labor market drove most of the growth. On the other hand, larger application pools, lower turnover rates, slower hiring, and easing wage pressures continue to point to a cooling labor market. A recent spate of headlines of companies announcing layoffs adds fuel to this story, though the last time this story played out the round of tech layoffs never really made a dent into overall employment reports.Allow us the opportunity to build you a custom Retirement Roadmap and we’ll send you a $100 Gas Card.

ADVISORS’ PERSPECTIVE

The Magnificent 7 rally propelling equity markets higher was a major theme of 2023, however in December there was a glimpse of a changing story as small and mid-cap stocks significantly outperformed large cap. However, that proved temporary as the volatility in the first part of January led to mid and small cap stocks to give us most, if not all of the relatively outperformance they had versus large cap stocks. While the Magnificent 7 stocks did well in January, it was not to the degree that they did last year. The Bloomberg Magnificent 7 Index outperformed the S&P 500 by less than 50 basis points in January.

Nearly half of S&P 500 constituents have reported their sales and earnings numbers for Q4, with an aggregate sales surprise of 1.14% and earnings surprise of 6.87%. So far, Health Care has the largest sales surprise of 2.30%, where last season it also did fairly well. Utilities are reporting the most negative sales surprise again at -6.47%. Meanwhile, Energy has the largest earnings surprise at 21.55%, where it was the only sector to report a negative surprise last season. All the other sectors have reported positive earnings surprises so far, with Health Care in second at 12.07%.

Fourth quarter GDP came in strong at an annualized rate of 3.3%, driven by a decrease in inflation that stimulated consumer spending. Consumer spending, which accounts for about two-thirds of the economy, saw broad growth across various sectors, contributing 1.9 percentage points to GDP. Personal spending rose 2.8% with gains in both goods and services. GDP is projected to grow between 0.5% and 1.5% quarter-over-quarter in 2024, according to a Bloomberg News survey.

The National Bureau of Economic Research (The NBER) evaluates key components such as Real Personal Income, Nonfarm Payrolls, Retail Sales etc… when assessing if we are in a recession or not. Payrolls came in over expectations where the outperformance was driven by gains in government and healthcare. Real personal incomes increased by 0.1%, however real personal consumption increased at a larger rate of 0.5%. The three months of gains in inflation-adjusted income are supportive of the latest retail sales report, but also point to increased use of credit to support spending habits.Looking ahead into 2024 economists are expecting consumer spending to decelerated (but stay positive) across the first half of the year and for industrial production to stay relatively tepid.

The Chinese economy is showing signs of fatigue, manufacturing has been slowing for 9 of last 10 months. Data on the Chinese economy can be both hard to come by and hard to trust, but the most recent manufacturing survey indicates the manufacturing and factory activity has been under pressure since April 2023. The weakness is despite stimulus measures the government has undertaken since the back half of last year and may mean that more stimulative measures are coming.Manufacturing weakness may compound China’s economic growth goals, already strained from the property crisis and deflationary pressures.

We remain cautiously optimistic and continue to use a quantitative investing approach. In times of uncertainty, it is more important than ever to follow the data and not make decisions based on emotions. Hilltops partnership with Helios relies on facts and data, which we use during our recalculations on a bi-weekly basis. Our models adjust appropriately to market conditions.

DISCLOSURE

This update is not intended to be relied upon as forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Hilltop Wealth Solutions to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecast made will materialize. Additional information about Hilltop Wealth Solutions is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary Report which are accessible online via the SEC’s Investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC # 801-115255. Hilltop Wealth Solutions is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting, or tax advice.

Past Meeting Highlights

December 2023