MARKET COMMENTARY

Investment Committee Meeting Highlights

June, 2023

MARKET UPDATE

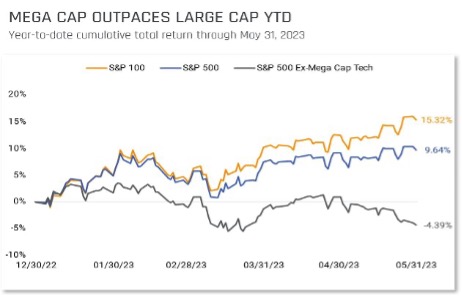

The S&P 500 outperformed its peers as large cap stocks gained 0.43% in May. Blockbuster earnings from NVIDIA helped push technology up 9.46% in the month. On a year-to-date basis, the S&P 500 is now up 9.64% with the largest names, such as Apple, Alphabet, Microsoft, and now Nvidia contributing the vast majority of those gains. Other equity markets were mixed with US mid cap stocks down 2.79% and small cap stocks down nearly 1%. Internationally, developed markets were down 4.23% while emerging markets were down 0.93%.

Expectations on what the Fed will do in their mid-June meeting shifted towards the end of May, with yields on short- and intermediate-term US government bonds rising. Previously, markets had expected the Fed’s latest 25 basis point increase in May to be the last one of this cycle, a message the Fed helped direct. However, by the end of May, markets are placing bets that there is one more rate hike in June. These expectations created headwinds for the bond market as the Bloomberg US Aggregate Index fell 1.09%.

There was a lot of chatter and headlines regarding the debt ceiling throughout the month. The Treasury warned that their ability to use “extraordinary measures” to avoid default, which began in mid-January, was going to run out in early June. The risk of default raised anxiety around markets and reminded investors of 2011 when S&P downgraded the United States’ credit rating. Similarly, the political brinksmanship led Fitch, a credit rating agency, to put the United States’ credit rating on a negative watch. However, over Memorial Day weekend a deal was announced that would pause the debt ceiling until 2025 along with a freeze on nondefense spending and a few other tweaks to various programs. The House passed the deal on May 31st with expectations it would clear the Senate and be signed before the deadline.

Allow us the opportunity to build you a custom Retirement Roadmap and we’ll send you a $100 Gas Card.

ADVISORS’ PERSPECTIVE

May began with a bout of volatility driven by further regional banking concerns, uncertainty related to the Fed’s continued rate policy, and headlines related to the debt ceiling. Despite early losses in the S&P 500 of just over 2.5%, the remainder of the month saw the S&P 500 recover on the back of a handful of technology companies, including NVIDIA, Meta, and Amazon. The largest US companies have contributed the majority of the gains within the S&P 500 on a year-to-date basis.

The 100 largest companies of the S&P 500 have gained over 16% YTD, while the S&P 500 is up just over 10% and the S&P 500 excluding mega cap tech, is slightly negative so far in 2023. Mega cap technology stocks have been insulated from the regional banking turmoil, and further boosted by the recent demand for AI-related items, exemplified by the major surge in the value of Nvidia in late May.

The first quarter earnings season is largely over with over 490 of the S&P 500 companies having reported results. Nearly 78% of reporting companies were able to beat analysts’ earnings estimates. While companies have been able to beat earnings estimates, overall earnings have declined 2.72% according to Bloomberg. However, companies have been able to expand their top-line revenue with over 68% percent of reporting companies growing revenue and aggregate revenue growing 4.24% across the S&P 500.

Following the Federal Reserve’s May meeting, where they increased rates another 25 basis points, the market had largely expected rate hikes to be over. Fed messaging seemed to confirm this viewpoint. However, in the latter half of May, the Fed futures market started to show a change in expectations. Towards the end of the month, the markets were placing a two-thirds probability that the Fed would further raise rates in their mid-June meeting. Instead, those probabilities came down to 26.4% by the end of the month.

At a high level, the economic data continues to suggest that a recession is not imminent and remains resilient, despite facing significant risks over the past year. While positive movements in equity markets kept equity implied volatility below its 2-year average, markets continue to try to digest mixed economic news with persistent inflation, as well as trying to anticipate what the Fed may do for the rest of the year, which can lead to sudden shifts in anticipated market risks.

We remain cautiously optimistic and continue to use a quantitative investing approach. In times of uncertainty, it is more important than ever to follow the data and not make decisions based on emotions. Hilltops partnership with Helios relies on facts and data, which we use during our recalculations on a bi-weekly basis. Our models adjust appropriately to market conditions.

DISCLOSURE

This update is not intended to be relied upon as forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Hilltop Wealth Solutions to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecast made will materialize. Additional information about Hilltop Wealth Solutions is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary Report which are accessible online via the SEC’s Investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC # 801-115255. Hilltop Wealth Solutions is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting, or tax advice.